Overview

Taking steps to ensure your current and future financial security is an important part of your overall well-being. The 401(k) Plan helps you prepare for retirement by offering an easy, tax-advantaged way to save for your future financial needs.

Key advantages at a glance

- Company profit-sharing contributions. You’ll share in the company’s success whether or not you contribute to the plan.

- Company match. DISH will match 50% of your contribution up to $5,000.

- Current tax savings. You’ll pay less in income taxes when you make pre-tax contributions.

- Tax-deferred investment growth. With pre-tax contributions, your money has the potential to grow faster.

- Wide range of investment choices. Choose how you want to invest your money.

- Convenient payroll deductions. The 401(k) Plan makes it easy to save for your future.

Eligibility & Enrollment

To be eligible for enrollment, you must be an employee who is at least 19 years old and who has completed at least 90 days of service. Unless you opt out, you will be automatically enrolled, and 3% of your eligible pre-tax pay will be invested in the Target Date Freedom Fund that most closely matches your retirement date, based on an assumed retirement age of 65. You may change your contribution rate and investment elections at any time by visiting the Fidelity website or calling 1-800-835-5095.

Your Contributions

You may contribute between 1% and 50% of your eligible pay to your plan account, up to annual IRS limits. In 2024, the IRS limits allow you to contribute up to:

- $23,000 if you are under age 50

- $30,500 if you’re age 50 or older this year (which includes an additional $7,500 in catch-up contributions, made as a separate dollar amount election).

These limits include your pre-tax contributions, Roth post-tax contributions, or a combination of both.

pre-tax vs. Roth post-tax: What’s the difference?

The 401(k) Plan gives you the flexibility to save for retirement in a variety of ways. You can make pre-tax contributions, Roth post-tax contributions, or a combination of the two.

pre-tax contributions

The money goes into your account before taxes are deducted, so you keep more of your take-home pay. Then, you’ll owe taxes on both your contributions and any investment earnings when you withdraw your money in retirement (when you may be in a lower income tax bracket).

Roth post-tax contributions

The money goes into your account after taxes are withheld. Then, both your contributions and any associated earnings can be withdrawn tax-free in retirement.*

* In order for Roth earnings to be withdrawn tax-free, you must meet these two requirements:

- At least five years have elapsed since your first Roth contribution.

- You are at least 59½ or the withdrawal follows death or total disability.

Catch up!

It’s not too late to make up for lost time. If you’ll be 50 or older this year, take advantage of the opportunity to contribute up to an additional $7,500 in catch-up contributions.

DISH Contributions

To help you reach your retirement planning goals, DISH will also contribute to your account!

Company profit-sharing contributions

Each year, at the Board of Directors’ discretion, DISH may make profit-sharing contributions to your account equal to a percentage of your eligible pay — whether or not you choose to contribute.

Company matching contributions

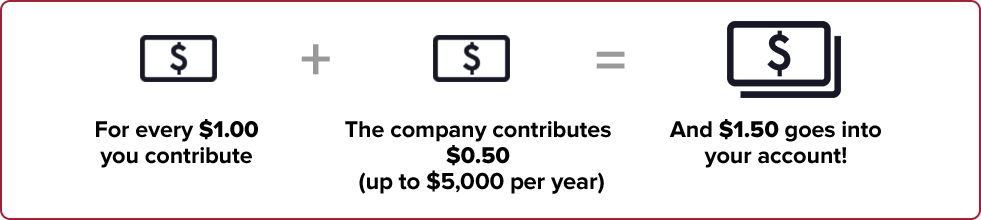

DISH matches 50% of your pre-tax and Roth post-tax contributions to the plan, up to $5,000 annually, to support your retirement saving efforts.

Here’s how the company match works:

Meet the match!

Try to contribute at least $10,000 to take full advantage of the match — otherwise, you’re leaving free money on the table. Log in to your Fidelity account to increase your contribution rate.

Vesting

Vesting is another way of saying “how much of the money is yours to keep if you leave the company.”

You are always 100% vested in your own contributions, including any investment gains and losses on the money. You become vested in company contributions over time, based on the following schedule:

| Your years of service | Your vested percentage |

|---|---|

| Less than 1 | 0% |

| 1 but less than 2 | 20% |

| 2 but less than 3 | 40% |

| 3 but less than 4 | 60% |

| 4 but less than 5 | 80% |

| 5 or more | 100% |

Name a Beneficiary

It’s important to designate a beneficiary to receive the value of your 401(k) Plan account in the event you die before beginning to receive your benefit. As personal circumstances change, be sure to keep that information up to date. Visit the Fidelity website to add or change a beneficiary.

Tools & Resources

Use Tools & Resources

Call 1-800-835-5095 to speak with a specialist or go to Fidelity. You can:

- Use a contribution calculator

- Watch videos on how the plan works

- Learn about your investment options

- And more.

Before investing, carefully consider the funds’ or investment options’ objectives, risks, charges, and expenses. Call 1-800-835-5095 for a prospectus and, if available, a summary prospectus, or an offering circular containing this and other information. Please read them carefully. Investing involves risk, including the risk of loss.